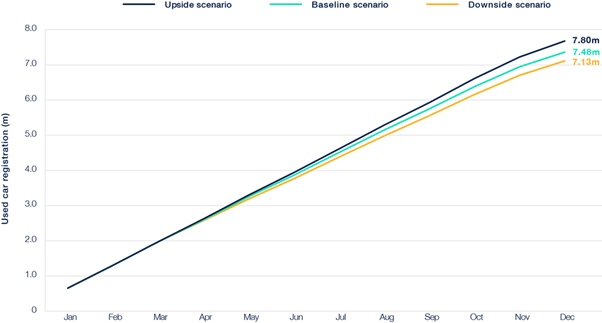

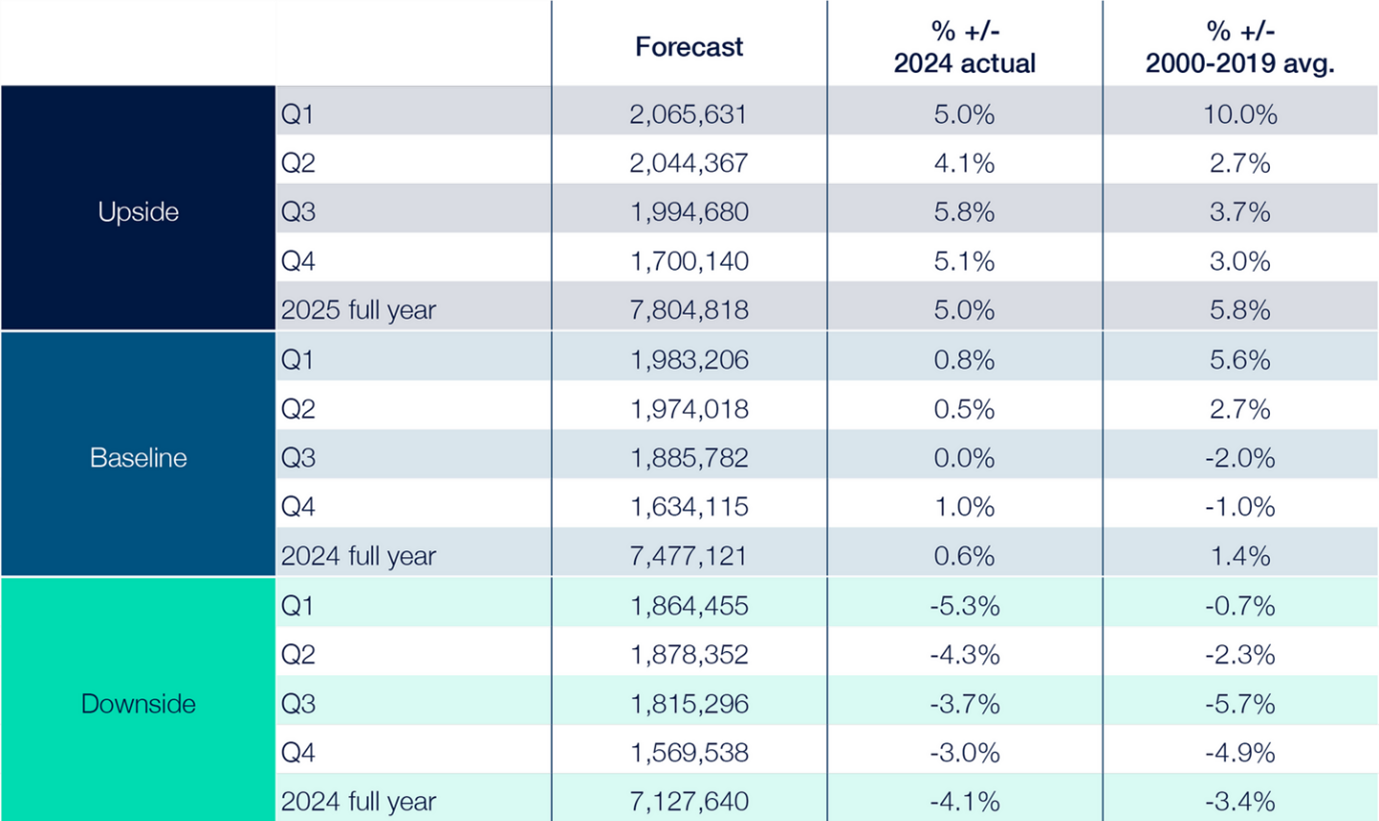

The UK used car market is projected to see only modest growth in the coming years, with transactions expected to rise from 7.4 million in 2024 to just under 7.9 million by 2027, according to the latest analysis from Cox Automotive.

Baseline projections for 2025, shared in Cox Automotive’s Insight Quarterly (IQ), indicate 7,458,356 used car transactions, a marginal 0.3% increase on 2024 levels.

This subdued trajectory highlights a market still lagging behind pre-pandemic trends and constrained by economic pressures and ongoing supply limitations.

Cox Automotive’s 2024 baseline accuracy (until the end of Q3) has tracked at 96.7% and 99.6% for its upside forecast.

“Demand for used vehicles remains stable, but the UK car parc is contracting, and overall vehicle registrations and transactions continue to fall short of peak levels seen from 2002-2008 and 2014-2019,” says Cox Automotive Insight Director, Philip Nothard.

He continues: “Our forecast highlights the enduring appeal of used vehicles but also emphasises the reality that this sector, like much of the broader automotive market, faces ongoing pressures as consumer priorities shift and the vehicle landscape continues to adapt.”

The influence of zero emission vehicles

The market’s evolving landscape is heavily influenced by increasing numbers of new energy vehicles (NEVs) along with changing production strategies among original equipment manufacturers (OEMs).

With more OEMs prioritising NEVs, the availability of traditional internal combustion engine (ICE) vehicles is expected to gradually decline.

Nothard says there is still a long way to go in bringing more dealers onboard to stock EVs, but those that have become early adopters are seeing certain models holding their value and even moving faster out the forecourts than some of their ICE equivalents.

In line with this, the forecast shows also predicts significant growth in NEV adoption within the used market, with battery electric vehicles (BEVs) increasing their share of transactions by over 50% in early 2024.

Despite this growth, ICE vehicles still dominate, especially given consumer concerns around EV charging infrastructure and affordability. However, BEV registrations in the used market are expected to grow from 21% to 34% by 2027, indicating a slow but steady shift in consumer preferences.

While the used car market is seeing gradual growth, it remains constrained by current economic conditions.

Modest declines in UK interest rates are expected over the next few years, though inflation remains above historical averages, limiting consumer purchasing power.

As a result, affordability will be a primary factor shaping consumer decisions, with many buyers viewing used cars as a more financially viable alternative to higher-priced new vehicles.

“Our data suggest economic pressures will continue to influence consumer behaviour,” Nothard explains.

“While new car prices rise, affordability concerns and a strong demand for lower-cost alternatives are likely to keep used car sales steady. With ongoing supply constraints and a shrinking car parc, we expect vehicle values for certain in-demand segments, particularly ICE, to remain high.”

UK car park to decline by nearly 5% over next three years

Over the next three years, the UK’s car parc is expected to decline by around 4.47%.

This shift presents new challenges for a sector that must balance dwindling ICE inventory with the growing demand for used EVs. As OEMs pivot to producing fewer ICE models, consumers may face fewer choices within the traditional fuel category, driving competition for high-quality used vehicles.

Cox Automotive’s data indicate a critical tipping point for the UK used car market by 2027.

The supply chain challenges brought about by the pandemic, which reduced new car registrations by over three million, have permanently affected the composition of the used car parc.

Now, as economic conditions stabilise and new vehicle supply becomes more consistent, the used market faces ongoing changes.

While UK used car transactions fell 12% between 2020 and 2023 compared to 2016-2019, forecasts suggest a gradual return to pre-pandemic levels by 2027. As NEV options become more accessible and consumer interest continues to build, demand for used cars of all types is likely to remain strong.

“The affordability and appeal of used cars will play a central role in the UK’s transition to an electrified future,” notes Nothard.

“The market is evolving, but the sector’s resilience is clear.

“Those in the sector who proactively adjust to shifting consumer preferences and stock needs will be well-positioned to thrive in a transformative market. But it certainly won’t be plain sailing ahead.”