Retail registrations dropped by 3.3% in November, while overall electric vehicles accounted for over a quarter of the market due to “unsustainable” levels of discounting, according to the Society of Motor Manufacturers and Traders (SMMT).

The growth in EVs by certain car manufacturers means that all brands can avoid fines from missing Zero Emission Vehicle (ZEV) mandate targets this year, if they buy credits from the top performers.

Demand from private buyers, among whom uptake has waned for two years, dropped to 58,496 units, accounting for fewer than four in 10 (38.1%) new registrations.

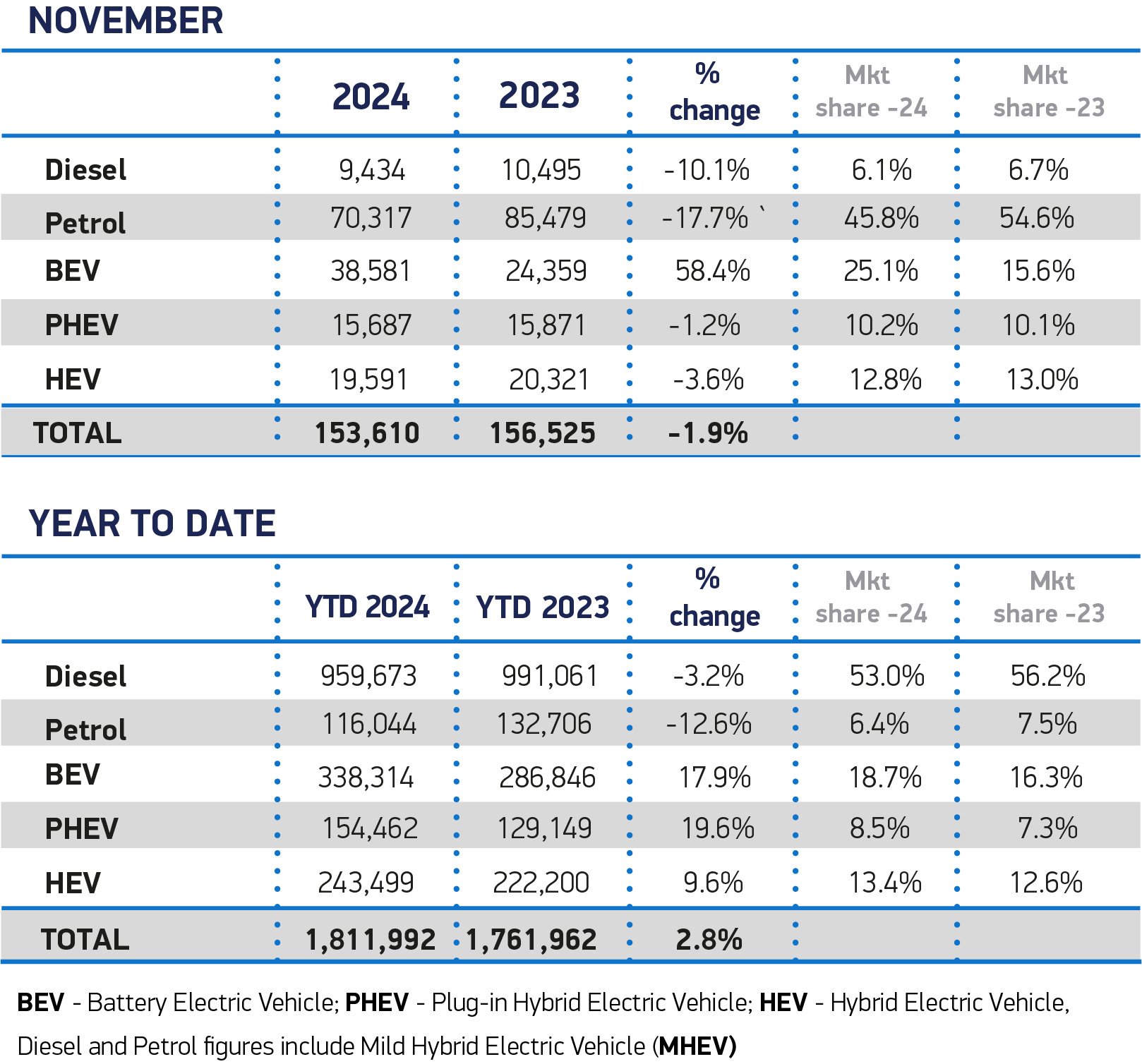

The total overall new car market saw a 1.9% drop in November, while combined fleet and business volumes recorded the lowest drop at 1% during the month.

November saw double-digit falls in registrations of petrol ( down 17.7%) and diesel ( down 10.1%) cars, with petrol remaining the most popular powertrain.

Hybrid and plug-in hybrid uptake also declined, by 3.6% and 1.2% respectively.

Battery electric vehicle (BEV) registrations, meanwhile, rose for an eleventh successive month, up 58.4% to 38,581 units, representing 25.1% of the overall market but driven by heavy manufacturer discounting.

With the best market share since December 2022, November is just the second month this year in which BEV uptake has reached mandated levels, albeit against the backdrop of a declining overall market.

According to the latest industry outlook, BEV registrations will need to grow by an additional 53% in 2025 if next year’s 28% mandated target is to be met – equivalent to 90,000 more businesses and consumers making the switch than the industry outlook expects.

Unsustainable EV incentives from OEMs, but they can avoid fines

Mike Hawes, SMMT chief executive (pictured), said: “Manufacturers are investing at unprecedented levels to bring new zero emission models to market and spending billions on compelling offers.

Mike Hawes, SMMT chief executive (pictured), said: “Manufacturers are investing at unprecedented levels to bring new zero emission models to market and spending billions on compelling offers.

“Such incentives are unsustainable – industry cannot deliver the UK’s world-leading ambitions alone. It is right, therefore, that government urgently reviews the market regulation and the support necessary to drive it, given EV registrations need to rise by over a half next year.

“Ambitious regulation, a bold plan for incentives and accelerated infrastructure rollout are essential for success, else UK jobs, investment and decarbonisation will be at further risk.”

New Automotive, transport research organisation, said the the performance of the UK’s EV market means that the car industry’s ZEV mandate credit surplus has almost doubled, meaning that no manufacturer will need to pay fines or make buyout payments to the Government this year.

Industry out-performance means that manufacturers who fall short of ZEV targets have a choice of nine brands from whom to buy credits. The glut of credits means that this is a buyer’s market.

For example every firm with a deficit could close it by buying from Tesla, BMW, Mercedes and Hyundai alone.

Mini leading the way in the UK

When it comes to manufacturers, domestic firms are leading the way. Mini, who operate out of Oxford, saw their electric models equate to 37% of their total new car sales, with the BMW Group selling more EVs than Tesla last month.

Other strong performers throughout November include Jaguar (with 36% of total car sales being electric), Vauxhall (36%), Peugeot (29%), Renault (27%), MG (27%) and Skoda (23%). Even lagging firms like VW and Ford exceeded their targets, with their EV market share totally 21% and 19% respectively.

Ben Nelmes, New AutoMotive chief executive, said: “Thanks to the investments and efforts made by carmakers, UK motorists now have more electric options at more competitive prices than ever before.

“This impressive progress is the result of the combination of ambitious and flexible EV targets, and significant tax breaks for electric cars. This combination of targets and incentives is putting the UK in the fast lane to greater energy independence and cheaper, cleaner motoring.

“November’s strong sales are accompanied by billions of investment in charging infrastructure and electric vehicle manufacturing. As global electric car sales wax and wane, the UK’s car market is heading in one direction – and fast. Ministers must not pull the rug under this progress as they revisit UK policy on EVs.”

The Government has launched a fast track consultation on the way the ZEV is implemented, although it’s not expected to change the 28% BEV market share target for next year, increasing to 100% in the coming years.

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said the consulation could be an opportunity to refine the implementation of the mandate, ensuring a smooth and sustainable transition.

He said: “A pragmatic approach to the ZEV mandate, alongside incentives for both manufacturers and consumers, will be crucial to drive electric vehicle uptake.

However, key economic indicators such as consumer confidence, inflation, and interest rates will continue to play a significant role in purchasing decisions.

“We also need to be realistic – people need to be able to afford EVs, have somewhere to charge them, and know the lights will stay on when they plug in. Get those basics right and we’ll see a much faster shift to a greener future.”

John Cassidy, managing director of sales at Close Brothers Motor Finance, also warned of “significant headwinds” facing car owners in 2025.

He said: “Although the fuel duty freeze extension will help motorists, consumer appetite for EVs certainly won’t be improved when owners will have to pay vehicle excise duty from next year.

“Manufacturers appear to be backtracking on electrification plans and many are sharing concerns over the ZEV mandate targets.

“This, along with the slow rollout of EV infrastructure, will need to be addressed urgently if the Government wishes to realistically achieve its 2035 ban on the sale of new petrol and diesel vehicles.”

Mini and Ford dominate top registrations performance

The Mini Cooper dominated registrations in November, while the ever popular Tesla Model Y continues to drive EV sales across the UK with a third place in November and top 10 position year-to-date.

The Ford Puma continues to step into the Fiesta’s previous role as the UK’s most popular vehicle year-to-date, with 45,538 registrations over the last 11 months.